If you were born before 23 September 1958, you could have been paid either £200 or £300 to help you pay your heating bills for winter 2024 to 2025. This is known as the ‘Winter Fuel Payment’.

Starting from winter 2024/2025, households in England and Wales will no longer be entitled to the Winter Fuel Payment unless they receive Pension Credit or certain other means-tested benefits. The Chancellor of the Exchequer, Rachel Reeves, announced this change, affecting 10.8 million pensioners in 7.6 million households.

A survey was conducted by UNITE following the Government announcement to remove the winter fuel allowance and found that two thirds of older people have now turned down their heating this year, due to this controversial policy.

One in four said they were feeling more depressed or anxious while 18% said they have become ill or their symptoms have worsened, since the changes in entitlement.

Many pensioners are struggling to manage on a day-to-day basis, due to suffering from disability and need to be aware that a person 66 or over may be entitled to Attendance Allowance which may qualify them to Guaranteed Pension Credit and other underlying entitlements like council tax support. Pensioners who are married or living together as spouse/civil partner suffering from disabilities, both can claim Attendance Allowance.

Pensioners can claim carer’s premiums if they provide care to each other and are potentially entitled to Guaranteed Pension Credit.

Albeit, a pensioner may be disabled, may not know about Attendance Allowance or how to claim.

We can help

A single pensioner or a couple, may not know they can claim Guaranteed Pension Credit.

We can help

Pensioners with capital can claim Guaranteed Pension Credit.

We can help

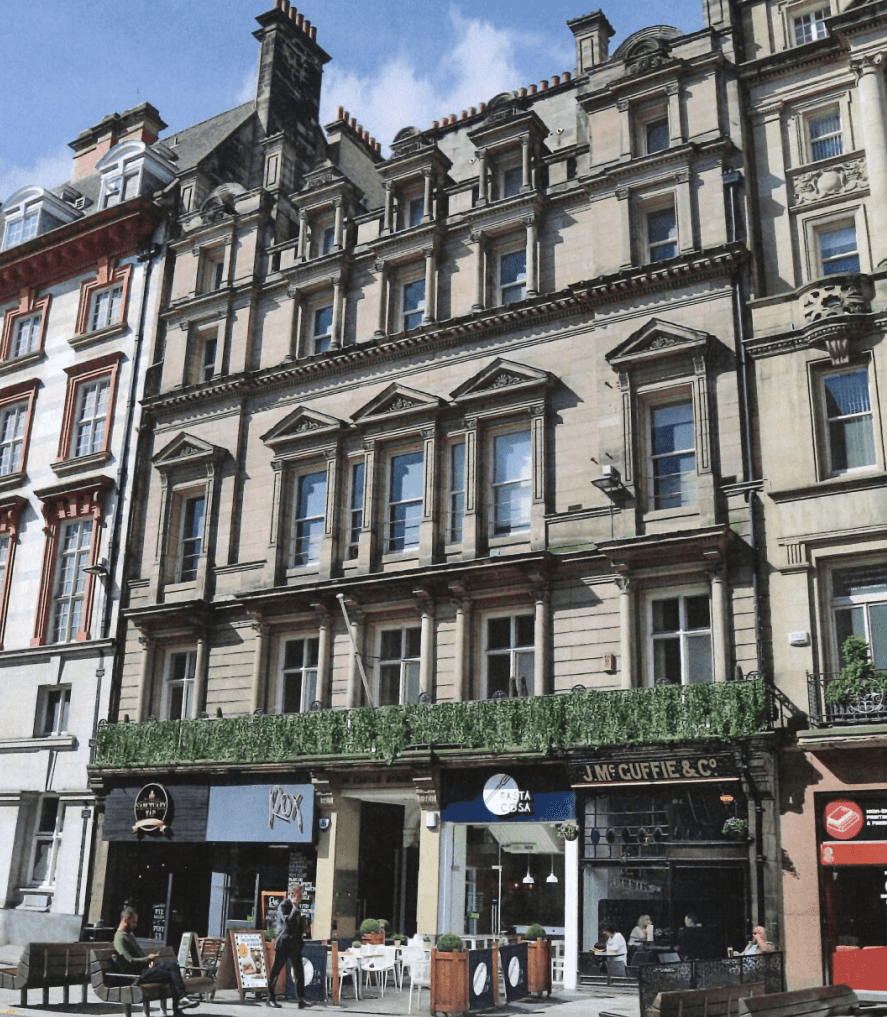

Contact our team of specialists on 0151 236 2225, email stevenlunt@a-l.law or elaineccokson@a-I.law