Understanding Lasting Power of Attorney: A Comprehensive Guide

Navigating the complexities of legal matters can often be daunting. One such area that requires careful consideration is the establishment of a Lasting Power of Attorney (LPA). This crucial legal document ensures your wishes are respected even when you’re unable to make decisions yourself.

What Is a Lasting Power of Attorney?

A Lasting Power of Attorney (LPA) is a legal document that allows you (the ‘donor’) to appoint one or more people (known as ‘attorneys’) to help you make decisions or to make decisions on your behalf. This power can be particularly useful if you become incapacitated due to illness, injury, or age-related conditions.

An LPA is designed to ensure that someone you trust is given the authority to handle specific aspects of your life should you be unable to do so yourself. It is a powerful tool that provides peace of mind, knowing that your personal, medical, and financial needs will be managed according to your preferences.

Types of Lasting Power of Attorney

There are two main types of LPA, each covering different aspects of decision-making:

- Health and Welfare LPA

This type of LPA covers decisions about your health and personal welfare. It includes decisions about medical treatment, daily care (such as diet and daily routines), and where you live. A Health and Welfare LPA only takes effect when you can no longer make these decisions yourself.

- Property and Financial Affairs LPA

This type of LPA deals with your financial matters. It includes managing bank accounts, paying bills, collecting benefits or pensions, and selling property. Unlike the Health and Welfare LPA, a Property and Financial Affairs LPA can be used as soon as it is registered, with your permission.

Why Is It Important to Have an LPA?

Having an LPA in place is essential for several reasons:

- Ensuring Your Wishes Are Respected

Without an LPA, decisions about your health and financial matters might be made by someone you wouldn’t have chosen. By setting up an LPA, you ensure that trusted individuals make decisions that align with your wishes.

- Avoiding Family Disputes

Family members may have differing opinions on what is best for you. An LPA minimises potential conflicts by clearly outlining who has the authority to make decisions, thereby preventing disputes during stressful times.

- Protecting Your Interests

An LPA can safeguard your assets and well-being against potential exploitation or mismanagement. Attorneys have a legal duty to act in your best interests, providing an additional layer of protection.

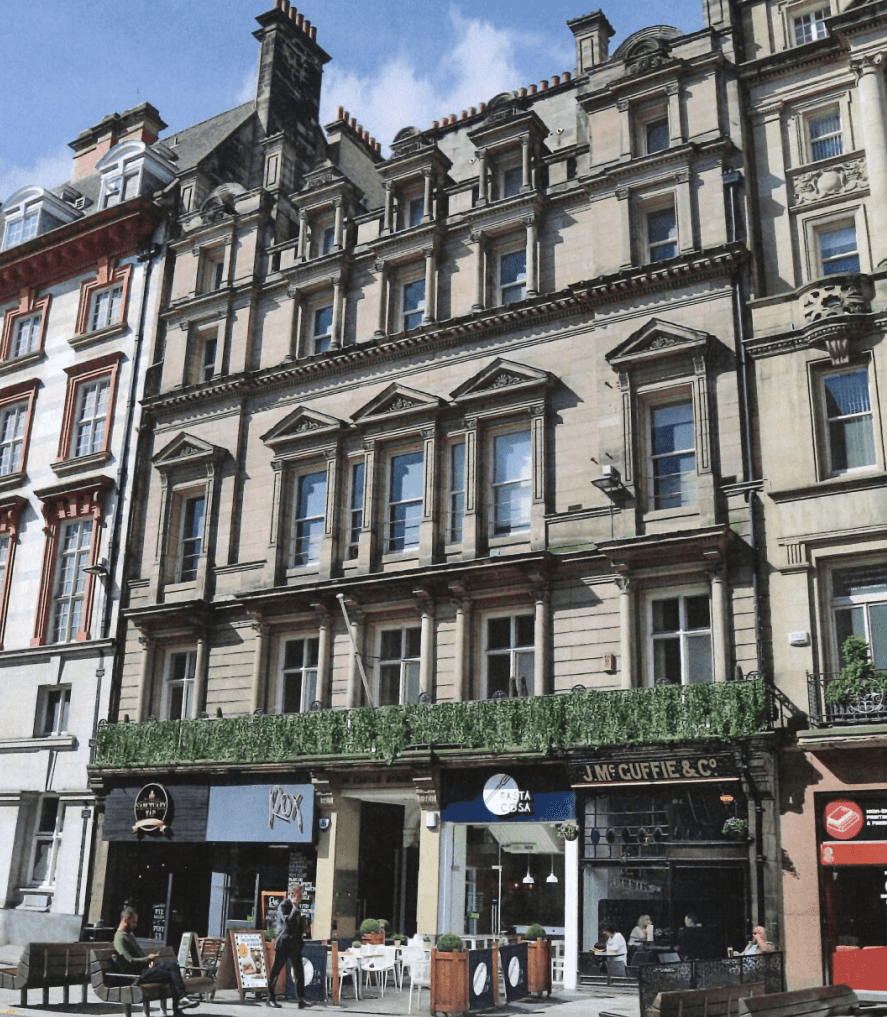

How Astraea Linskills Can Help

At Astraea Linskills, we understand the significance of establishing a Lasting Power of Attorney and strive to make the process as smooth and comprehensive as possible. Our experienced legal team offers bespoke services tailored to your unique needs, taking the time to understand your individual circumstances and wishes, resulting in an LPA that truly reflects your desires. Whether it’s handling complex financial affairs or ensuring your healthcare preferences are met, our personalised approach ensures everything is taken into account.

Safeguard your future with Astraea Linskills

Whether it’s for health and welfare or property and financial affairs, having an LPA in place ensures your wishes are honoured and brings peace of mind for you and your loved ones. Astraea Linskills is here to guide you through this process with expertise, compassion, and dedication. Contact us today to learn more about how we can assist you in setting up a Lasting Power of Attorney – 0330 128 1660.