The Personal Independence Payment Appeal was successful, and we secured an award of Personal Independence Payment, which was backdated to 2016. This did have an impact on our client’s entitlement to increase Income Support, also from 2016.

Overview of the case

We were instructed by Miss X in February 2023 with regard to a new claim for Personal Independence Payment. For several years Miss X has suffered from:

- complex partial seizures

- incontinence

- anxiety

- memory loss

- depression

- lower back pain

During Miss X’s initial consultation, on discussing her health, it transpired that Miss X had submitted a new claim for Personal Independence Payment in November 2016, but that claim was unfortunately disallowed.

We advised and assisted Miss X with the new claim for Personal Independence Payment. We also discussed the changes in legislation, which included significant changes in the points system, taking into consideration whether supervision is ‘reasonably required’ to achieve various activities of the daily living component of Personal Independence Payment. There were also changes in legislation to a claimant’s ability to follow a familiar route safely, alone.

Prior to February 2018, Personal Independence Payment legislation did not include whether supervision is reasonably required, particularly regarding those who suffered from Epilepsy, with seizures which occur without warning. Prior to February 2018, Personal Independence Payment did need to take into consideration whether such seizures occurred for the majority of the week. Whereby claims for Personal Independence Payment for claimants who suffered epilepsy found their claims being disallowed prior to February 2018.

In February 2018, the Upper Tribunal reported the decision RJ-v-SSWP. The changes were substantial whereby the Upper Tribunal held, allowing the appeals, that:

- The meaning of “safety” and the definition of “supervision” in part 1 of Schedule 1 of the Personal Independence Payment Regulations was to be approached consistently with “safety” in Regulation 4 (4) (a) (paragraph 27).

- An assessment under paragraph 4 (2a) (a) of the PIP Regulations that an activity cannot be carried out safely did not require that the occurrence of harm was “more likely than not”. A Tribunal must consider whether there was a real possibility that could not be ignored of harm occurring, having regard to the nature and gravity of feared harm in a particular case. However, the likelihood of the harm occurring and the severity of the consequences were relevant in accordance with paragraphs 33, 37 and 56 of RJ-v-SSWP.

- If, for a majority of the days, a claimant was unable to carry out an activity safely or required supervision to do so, then the relevant descriptor applied. That may be so evened out that the harm to prevent an event, which triggered the risk, actually occurred on less than 50% of the day.

- The same approach applied to the assessment of a need for supervision in paragraph 56 of RJ-v SSWP.

Therefore, given Miss X had submitted a claim for Personal Independence Payment in November 2016, this was prior to the changes in the legislation whereby RJ-v-SSWP applied retrospectively from 23rd March 2017. We invited the Secretary of State to review the Personal Independence Payment claim submitted by our client in November 2016.

Our request was declined, and the advice received back from Personal Independence Payment was “your client’s claim for Personal Independence Payment has been reviewed on three separate occasions, arriving at the same conclusion that the changes in legislation did not apply”.

How We Turned it Into a Successful Claim

Obviously, this was not the case due to the unpredictability of epileptic seizures occurring without warning, and Miss X could take no appropriate action to prevent danger because of a seizure. Therefore, the guidance provided by RJ-v-SSWP applied to Miss X.

The new claim for Personal Independence Payment was successful in part. Miss X was awarded the mobility component at the enhanced rate due to being unable to follow a familiar route alone because of reasons of safety. However, the daily living component was declined.

We challenged the decision with the Department for Works & Pensions, which is called a Mandatory Reconsideration request, but the Secretary of State upheld the original decision not to award the daily living component of Personal Independence Payment. Obviously, continuing to ignore changes in legislation implemented by the 3-panel Commissioners in accordance with RJ-v-SWWP.

We then pursued an appeal on behalf of Miss X to a FirstTier Tribunal at HM Courts & Tribunal Service. We were provided with a bundle of appeal papers from the Department for Works & Pensions, but the Department for Works & Pensions failed to address the reasons for refusing the new claim for Personal Independence Payment in November 2016. The Secretary of State did confirm that they had reviewed the earlier decision on three separate occasions and arrived at the same conclusion that the changes in legislation did not apply. However, the Department for Works & Pensions omitted to provide us with copies of those decisions in the appeal bundle.

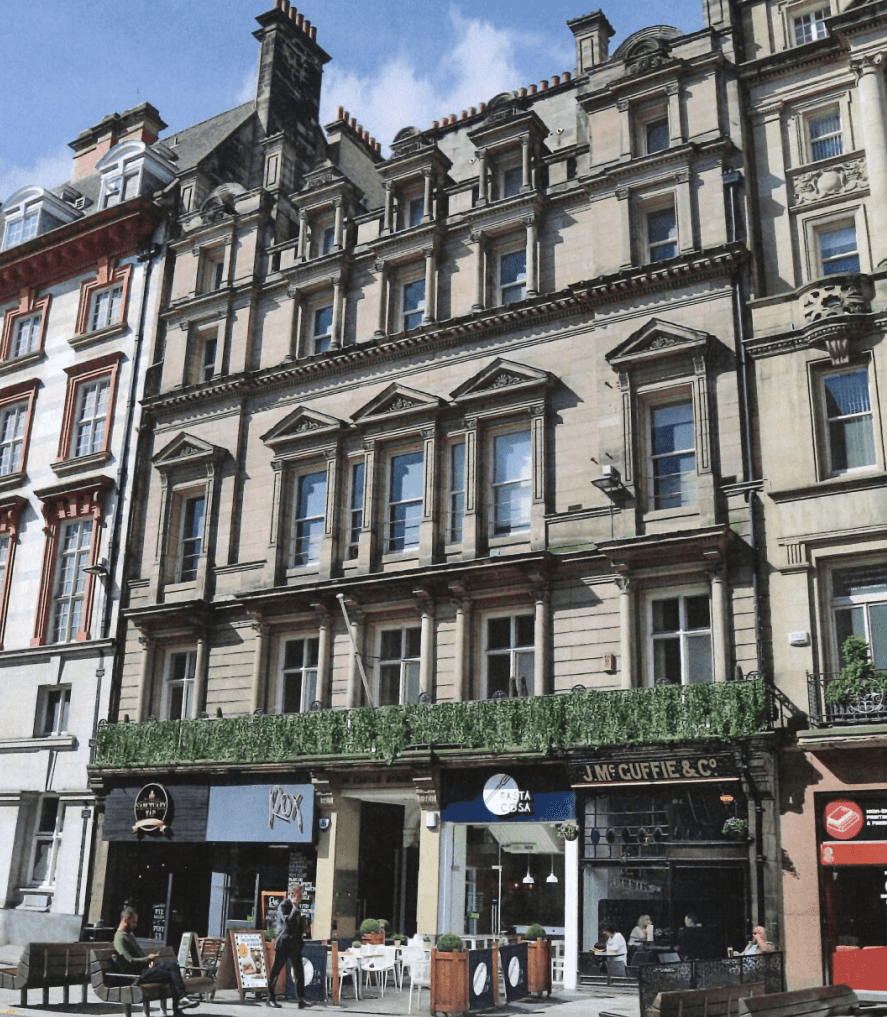

The appeal was considered by a panel of 3 at the First Tier Tribunal, Liverpool Venue, in September 2023 and after strong representations made on behalf of Miss X, the First Tier Tribunal agreed to award the daily living component of Personal Independence Payment for the new claim at the enhanced rate, and readily accepted that the decision purportedly made in 2019 be set aside, due to official error, and Miss X was also awarded Personal Independence Payment daily living component at the standard rate and mobility component at the enhanced rate from November 2016 to 2022.

Therefore, we were able to secure seven years of arrears of Personal Independence Payment.

During this period in question, Miss X was receiving Income Support as a carer for a disabled child, and as a result of the revised decision to award Personal Independence Payment from November 2016, she became entitled to a Disability Premium at the single rate and the Severe Disability Premium at the single rate to be included from the Income Support from November 2016.

Miss X was delighted and did feel that justification has now been done with regards to her claims for Personal Independence Payment and confirms that the arrears of benefit will change her and her family’s life.

As a result of the successful Personal Independence Payment appeal, we will now be able to secure arrears in excess of £80,000 as a combination of Personal Independence Payment and Income Support arrears.

Albeit the Department for Works & Pensions refused the claim for Personal Independence Payment from 2016, it should be noted that they did not attend the First Tier Tribunal to represent the Department for Works & Pensions, as I believe that they had no defence.